Mirrorless Camera Adoption and Increased Average Purchase Values

Published 21 November 2024 by MPB

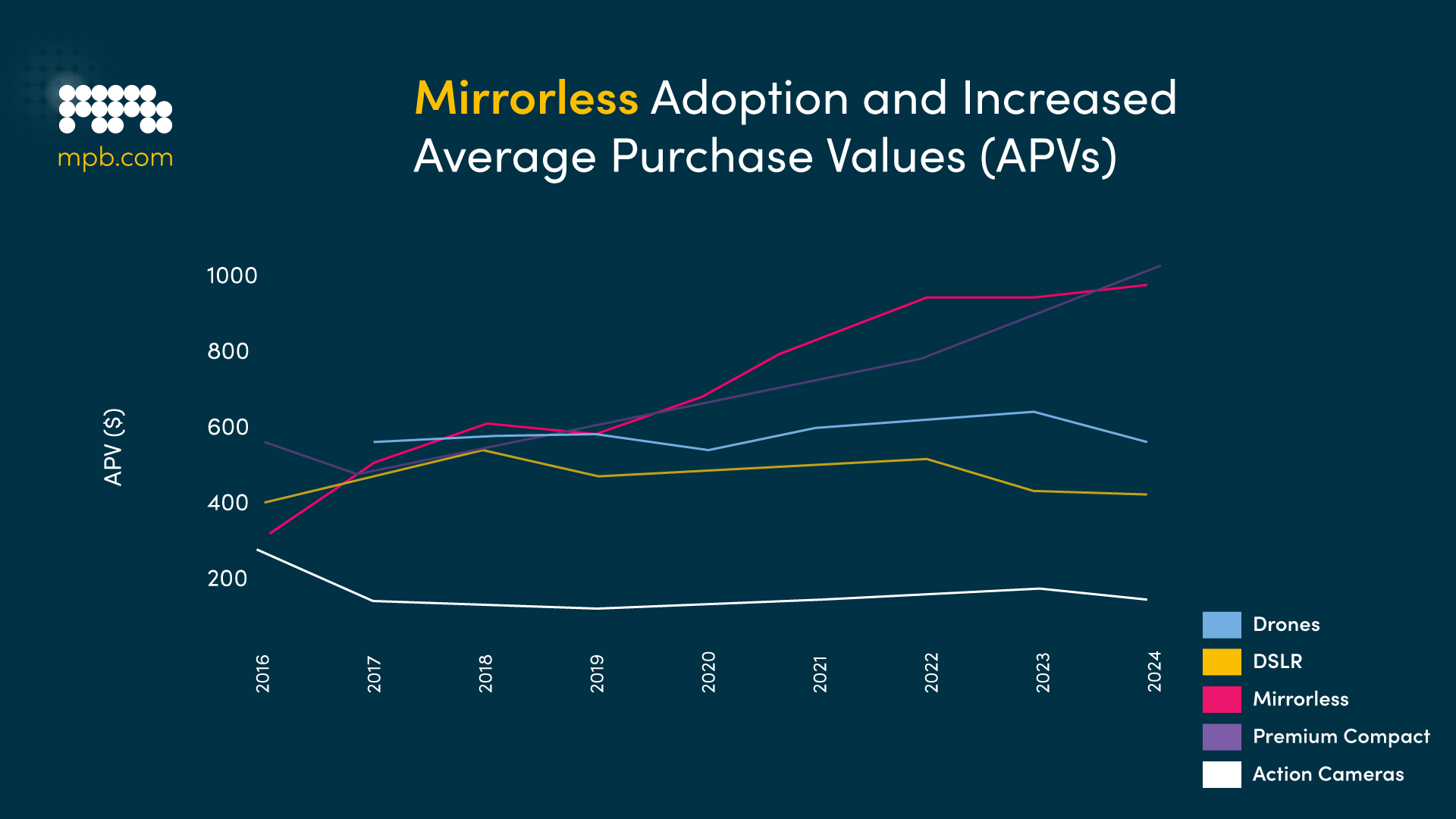

The influence of mirrorless camera adoption on Average Purchase Values (APVs) in the new and used camera market has been significant. The impact is driven by several factors, including technological advancements, shifting consumer preferences, and the broader impact of these cameras on market dynamics.

The Rise of Mirrorless Cameras in the Primary Market

Mirrorless cameras have experienced a surge in popularity within the market largely attributed to their technological advancements over traditional DSLRs. These cameras offer benefits such as reduced weight, quicker autofocus and enhanced video capabilities. Consequently they are increasingly preferred by both professional and amateur photographers. The market share of mirrorless cameras has seen growth with these models constituting a considerable portion of global camera sales. Data from the first half of 2024 shows volume of mirrorless units was up 16% year-on-year, and compact cameras up 9%, while DSLR units were down 22%.

The rising demand, influenced by manufacturers focussing on the premium end of the market with improved functionality, has led to an increase in APVs within the market. Consumers are willing to spend more on mirrorless cameras that deliver features and performance. Brands like Sony and Nikon have leveraged this trend by introducing top tier models, with Canon finally releasing a flagship model (the Canon EOS R1) in 2024, further elevating the price points.

Impact on the Used Market

The rising popularity of mirrorless cameras in the primary market is also influencing the used market. With more consumers switching to mirrorless models, there is an increasing availability of used cameras, particularly older mirrorless models, in the secondary market. This surge in high quality used cameras has led to prices increasing in the used market as well. Buyers are often willing to pay more for well-maintained cameras that still offer advanced features at a lower cost than brand-new models.

Additionally the durable construction and long lifespan of mirrorless cameras ensure that they hold their value over time making them an appealing choice. Consequently the resale value of mirrorless cameras remains significant, contributing to the rise in values in the market.

The adoption of mirrorless cameras in the primary market has had a notable impact on both primary and secondary market APVs. As consumers increasingly opt for mirrorless models due to their advanced features, the average purchase value in the primary market has risen. Simultaneously, the high resale value and continued demand for used mirrorless cameras have driven up APVs in the used market. This dual impact highlights the significant role mirrorless cameras play in shaping the broader digital interchangeable-lens camera (DILC) landscape. With the newer, more premium, models due to enter the secondary market in the next three to four years, we can expect APVs to continue to increase.

The MPB Used Camera Gear Price Index is an interactive visualisation of used camera and lens pricing trends. The index is powered by MPB, the leading authority on used camera prices, and largest global platform to buy, sell and trade used camera equipment.

View price trends over 3 to 36 months for the 100 most popular products. Delve further into the data to see trends by camera brand and product type. MPB's index shows trends individually across the United States, the European Union and the United Kingdom.

MPB is sharing its market-leading used camera gear expertise to open up the world of visual storytelling in a way that's good for people and the planet. Alongside the index, MPB publishes insightful stories on the latest pricing trends. MPB has made its index free for the public and press to use.