Fujifilm Popularity Continues: 2024 Pricing Analysis

Published 10 December 2024 by MPB

The secondary camera market has seen dynamic changes in pricing over time, with notable trends across brands and camera types in the United States in particular. Using our data, from the MPB Used Camera Gear Price Index, we can see clear trends impacting the economics of the market. The Index tracks a weighted pricing movement over time for a fixed group of the 100 most popular products, removing the impact of mix to focus purely on price movements through the period.

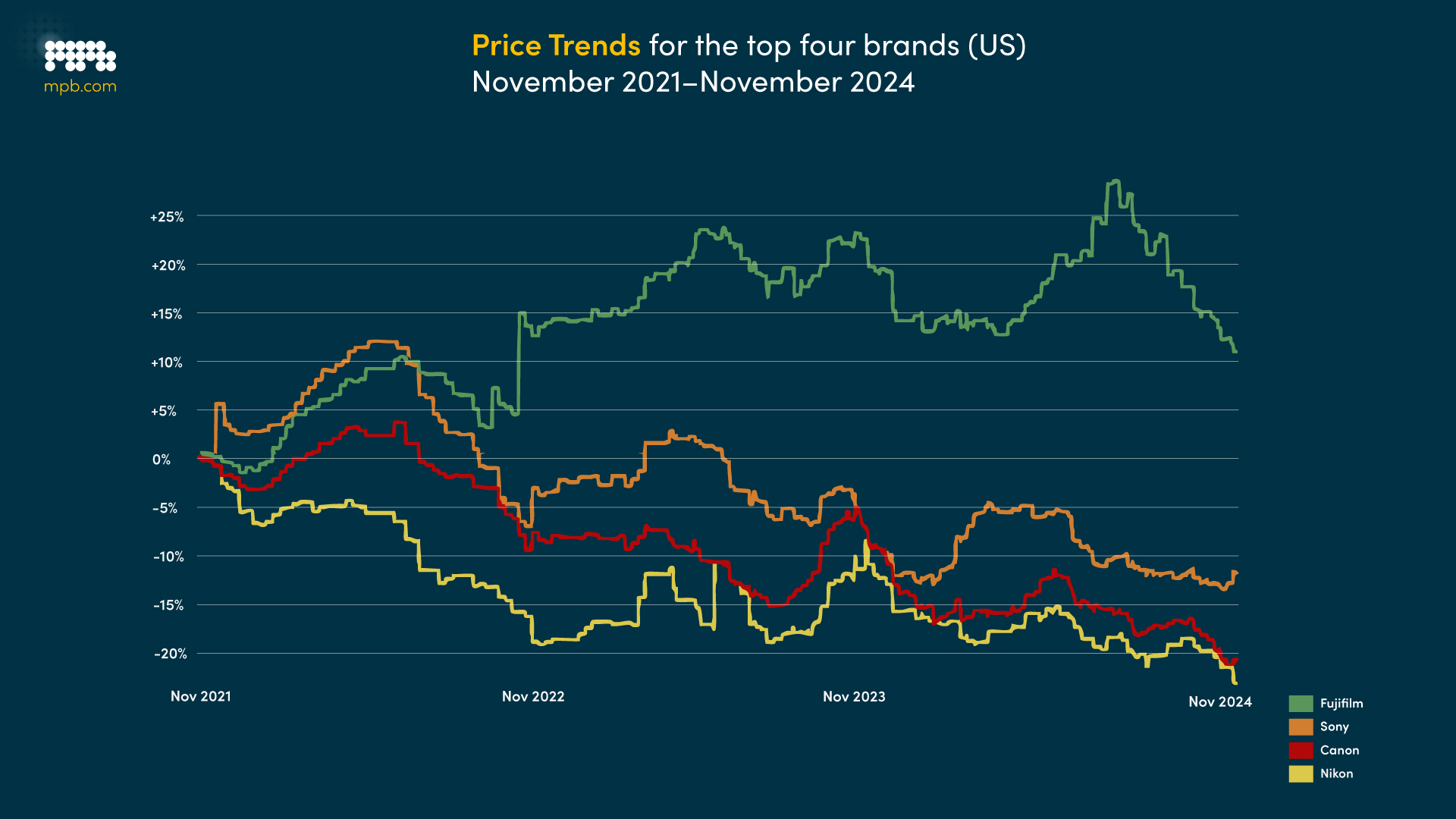

Price trends for the top four brands, United States, December 2021–December 2024 | MPB Used Camera Gear Price Index

Price Trends by Brand

Models from Sony, Nikon and Canon show an expected downward trend in used market values, with prices of individual models decreasing over time since release, as technology evolves and newer models come into the market.

However, Fujifilm stands out with an almost 10% net increase in value of selected models over three years. This positive trend highlights its unique market positioning and high demand, especially evident from February to July 2024, coinciding with the launch of the Fujifilm X100VI. The latest in the popular X100 series spurred both buying and selling activity, leading to a wider inventory and heightened interest. Fujifilm’s focus on mirrorless and compact models, rather than DSLRs, has helped it maintain a loyal customer base and a robust resale market, allowing prices to stay strong.

Price Trends by Camera Type

DSLR models featured in the index have taken the steepest change in value over time, with values falling by about 38% over the past three years. This is a direct consequence of the industry-wide shift toward mirrorless systems, which offer greater portability and advanced features that appeal to today’s photographers. As more users transition to mirrorless, the market has seen a higher supply of second-hand DSLRs, driving down prices even further. In contrast, mirrorless cameras have shown a more moderate decline, with prices across selected models decreasing around 15% over the same period. Despite frequent new releases, older mirrorless models retain value better than DSLRs, indicating continued strong demand. However, DSLR models continue to offer an attractive option for buyers looking at high spec models at a lower price point.

Perhaps the most unexpected finding is the resilience of premium compact cameras, which have recorded a net positive price change of nearly 9%. These compact models are highly sought after by enthusiasts who want a portable yet high-quality camera, particularly for travel. This niche demand seems to have supported prices in a way we don’t see with other types. Mid-2023 and mid-2024 saw notable price spikes for premium compacts, likely due to increased seasonal demand as more people look for quality compact options when planning trips or vacations.

The ongoing reduction in DSLR prices matches the shift in consumer preferences, as more photographers, both professional and amateur, move toward mirrorless systems. Canon, in particular, has experienced sharper price drops as it transitions its lineup to emphasise mirrorless technology. At the same time, the stability of premium compact camera prices shows that, despite smartphone advances, there remains a strong market for high-quality portable cameras. These compacts, often favoured by creators seeking a more ‘vintage’ aesthetic, offer a unique value that smartphone cameras can't easily replicate.

Seasonal Demand and Volatility

Seasonal demand has also influenced camera prices across categories. In mirrorless and premium compact segments, we see price increases during peak buying times, such as holiday shopping seasons and back-to-school periods. New product launches, summer promotions, and specific photography events all contribute to these temporary demand surges, which can affect resale values in the short term.

Finally, supply chain and inventory adjustments have introduced some volatility, especially noticeable in 2023. The post-pandemic period has disrupted production and logistics for many consumer electronics, cameras included, leading to inconsistent inventory levels and fluctuating prices. For both buyers and sellers, understanding these pricing patterns and market shifts can help inform better decisions on when to buy or sell, and which models may hold their value longer.

The MPB Used Camera Gear Price Index is an interactive visualisation of used camera and lens pricing trends. The index is powered by MPB, the leading authority on used camera prices, and largest global platform to buy, sell and trade used camera equipment.

View price trends over 3 to 36 months for the 100 most popular products. Delve further into the data to see trends by camera brand and product type. MPB's index shows trends individually across the United States, the European Union and the United Kingdom.

MPB is sharing its market-leading used camera gear expertise to open up the world of visual storytelling in a way that's good for people and the planet. Alongside the index, MPB publishes insightful stories on the latest pricing trends. MPB has made its index free for the public and press to use.