Challenger Camera Brands Continue to Take Market Share

Published 17 December 2024 by MPB

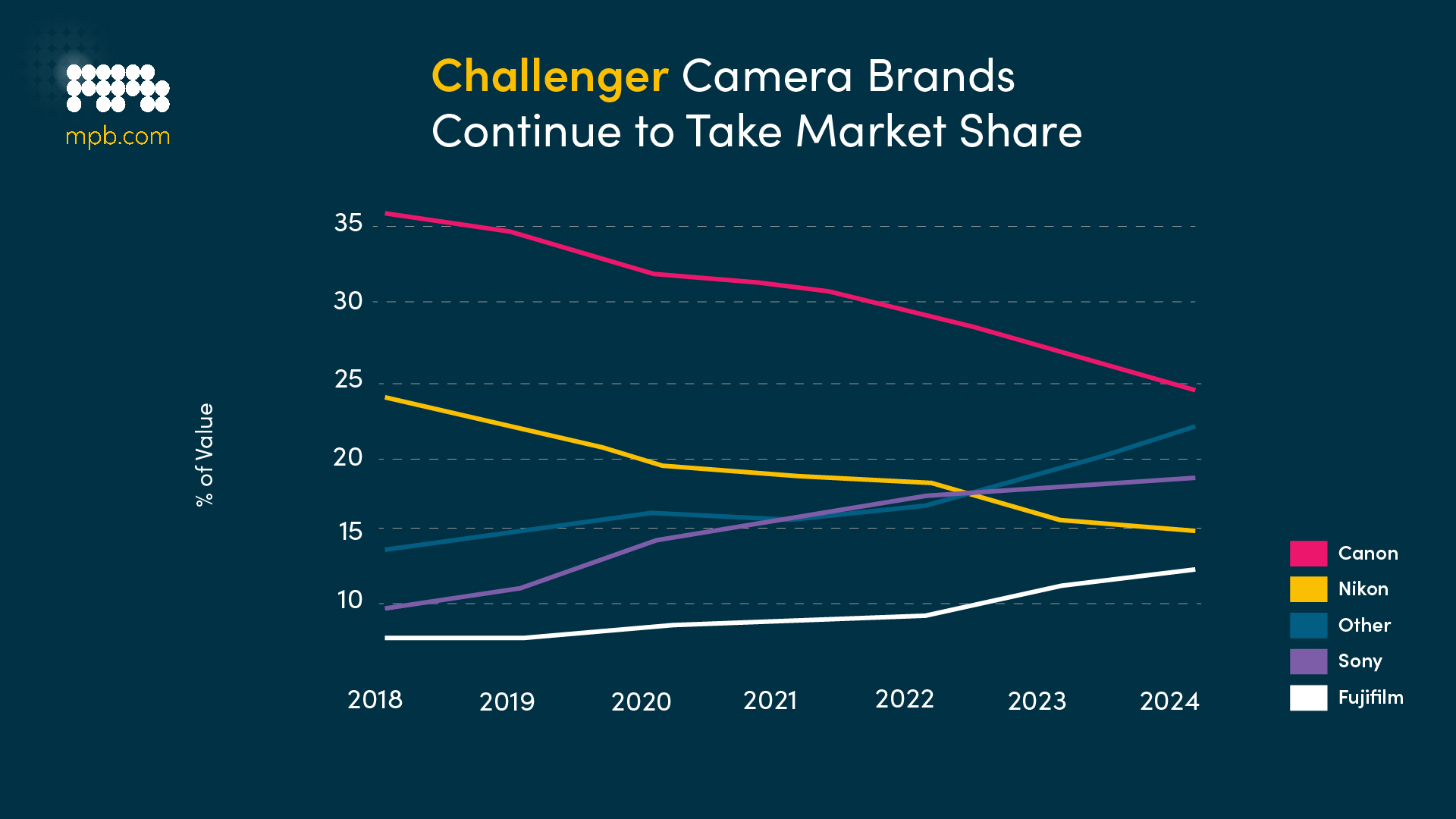

In 2023, the mirrorless system overtook DSLR across the new and used markets. Our latest data from the used market shows that the traditional leaders, Canon and Nikon, continue to lose ground to other manufacturers.

Younger photographers are flocking to Fujifilm APS-C cameras for their vintage-style design and convenient direct-to-JPEG stills. Having gained a retro fanbase on TikTok, Fujifilm’s design-focused cameras are leading the compact camera revival, alongside those by Ricoh and Leica. The new market demand couldn't keep up with the popularity of the X100V and saw a boom in related Fujifilm lines. As Fujifilm released the X100VI in 2024, we expect Fujifilm’s popularity to continue through the new and used markets.

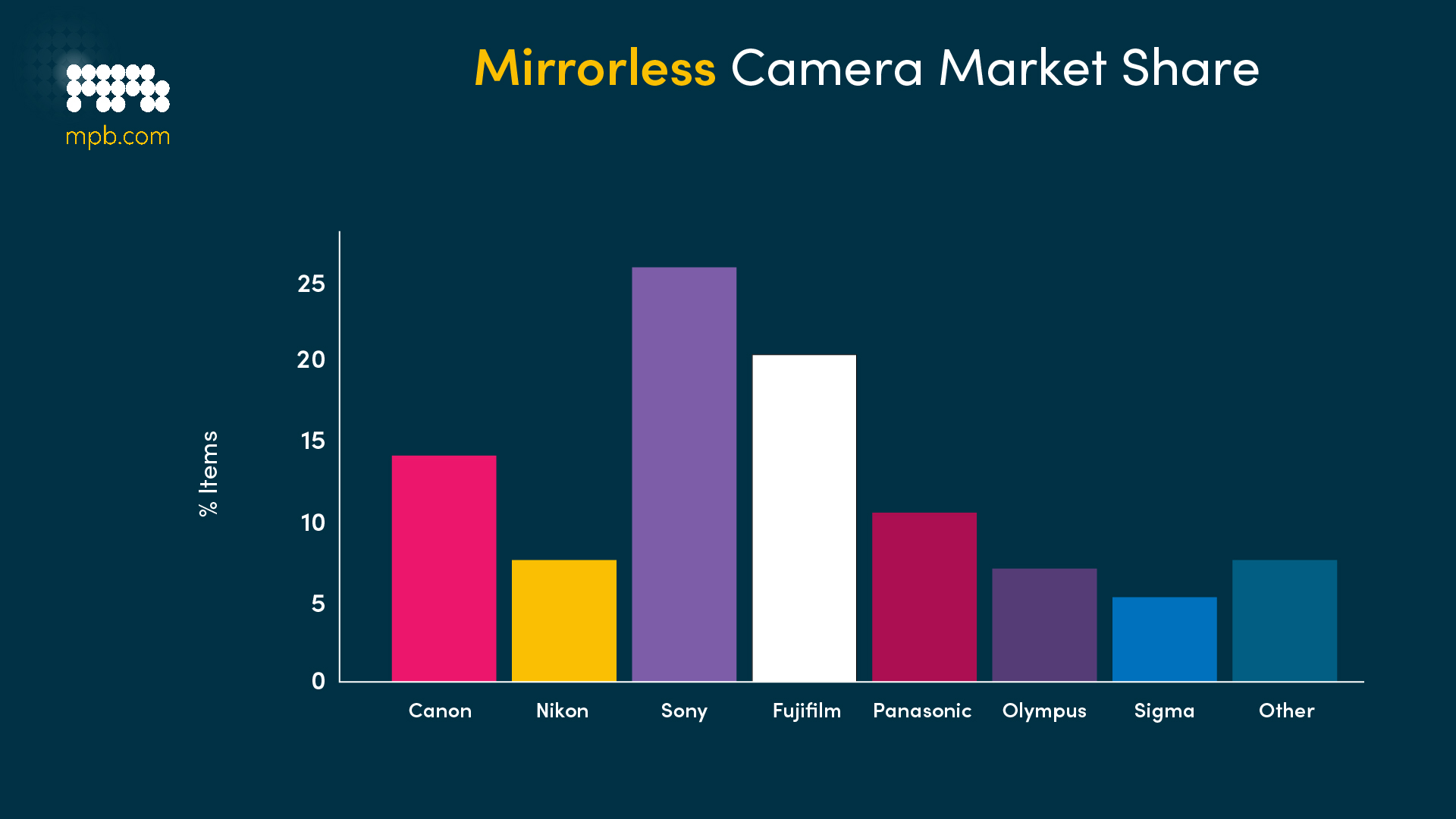

Meanwhile, impressive Sony full-frame mirrorless cameras are turning the heads of professional photographers and hybrid videographers. In 2023, the Sony A7 III was our most popular camera body. Sony has recently released updates to the A7 range, with new vlogging-dedicated cameras and the FX video-focussed line.

However, a closer look at our data reveals that Canon and Nikon are still the most popular brands in the used market overall.

With the largest market share in both value and volume, Canon remains the most significant player in the used market. Alongside the ongoing popularity of discontinued Canon DSLR models, our data shows growing adoption of Canon’s mirrorless RF system among visual storytellers. In particular, the Canon EOS R6 and R10 featured in 2023’s fastest-rising camera gear across the United Kingdom, United States and European Union.

As Canon releases a strong product pipeline into the new market, we expect Canon’s popularity will continue through the coming months in the used market.

Sony has now overtaken Nikon in value share of the used market. However, Nikon is still ahead of Sony in volume share, with more Nikon units traded annually. Nikon’s volume lead is due to their large number of DSLRs, alongside the increasing demand for the well-respected Nikon Z mirrorless system. With the releases of the Nikon Z9 and Z8, alongside the retro-inspired Zf, Nikon sales have increased. The Z9, in particular, is considered to be the top full-frame option for professionals in 2024.

The top four manufacturers (Canon, Nikon, Sony and Fujifilm) share 68% of the used market, down from 74% in 2020, due to the rising popularity of third-party lens manufacturers like Sigma, Tamron and Samyang.

Premium models, with a shorter inventory tail, contribute towards Sony and Fujifilm’s higher average product value in the used market. Despite strong RF-mount and Z-mount offerings, Canon and Nikon DSLR models are far greater in number, reducing the average value of Canon and Nikon products.

It is now an exciting time for photographers and videographers. In recent years, the rise of mirrorless has led to more competition—and innovation—among camera manufacturers.

Used market share of mirrorless cameras by brand, early 2024

Initially caught off-guard by the rapid developments in mirrorless technology, Canon and Nikon are now catching up. All the camera manufacturers are now in a mirrorless arms race, which is excellent news for consumers.

Technological breakthroughs, providing an ever-improving and widening array of tools, allow visual storytellers to exceed their creative requirements and keep pushing the boundaries of photography and video. As these developments continue to enter the used market, there are more options available to visual storytellers than ever before.

The MPB Used Camera Gear Price Index is an interactive visualisation of used camera and lens pricing trends. The index is powered by MPB, the leading authority on used camera prices, and largest global platform to buy, sell and trade used camera equipment.

View price trends over 3 to 36 months for the 100 most popular products. Delve further into the data to see trends by camera brand and product type. MPB's index shows trends individually across the United States, the European Union and the United Kingdom.

MPB is sharing its market-leading used camera gear expertise to open up the world of visual storytelling in a way that's good for people and the planet. Alongside the index, MPB publishes insightful stories on the latest pricing trends. MPB has made its index free for the public and press to use.